EMPIRE HYDROGEN {Investors Cautioned}

EMPIRE HYDROGEN ENERGY SYSTEMS INC

{Investors claim capital stolen from previous venture “Marenor Fish Ranches Inc”.}

It is alleged that, In 1986 Tjelta was raising funds for a startup, “Marenor Fish Ranches Inc., Langley, BC Canada”. In his business dealings with potential investors Tjelta represented himself as a trustee for the safekeeping of funds for the fish ranch project. Tjelta has a history of developing and raising funds for startup projects.

- Sven Roy Tjelta – (CEO/President of Empire Hydrogen Energy Systems) –

- Past President – Marenor Fish Ranches Inc. #101-20644 Eastleigh Cresent, Langley, BC Canada

- Sven O. Tjelta aka: Roy Tjelta vs. Hai Yan Wang: Accused of Fraud in Business Dealings (Supreme Court British Columbia)

Empire Hydrogen Energy System’s Inc. website describes Tjelta as a management consultant with broad theoretical knowledge and diverse practical experience. “As an entrepreneur Mr. Tjelta has owned and successfully operated businesses in the following sectors: auto collision repair, real estate, construction, a health care facility, industrial electronics services, mortgage business, bio-medical technology, mergers and acquisitions, initial public offerings (IPOS), private placements, medical care clinics, debt counseling and marriage counseling.”

What is not transparent is that Roy Tjelta has been involved in many business ventures that have failed in which he has been accused to have mismanagement or misappropriated investor funds.

According to investors, “Marenor Fish Ranches Inc.” was a startup project for which Tjelta was in charge of raising funds and eventually preparing the company for an IPO. Investors were promised “Marenor Fish Ranches Inc.” would be a “turnkey” operation.

Investors were given “Subscription Forms” to purchase shares, “Pooling Agreements”-are a contractual arrangement by which corporate shareholders agree that their shares will be voted as a unit. Therefore, a voting trust is created between a group of stockholders and the trustee to whom they transfer their voting rights. “Contracts” for construction along with specific details regarding compliance and other documents were issued in order give the appearance and legitimize their investment. The shares purchased were to be held in “trust” by Marenor’s Registrar and Transfer Agent (Tjelta) until Marenor became a reporting company and the Superintendent of Brokers of British Columbia authorized the release of Peterson’s share certificates.

Audit Findings – As a result of the dismal cash position of Marenor, the Board of Directors requested an audit of the company be conducted. This was accomplished by Chambers, Phillips & Company, Chartered Public Accountants, 950-409 Granville Street, Vancouver, B.C., Canada, V6C 172.

In a letter to the shareholders of Marenor they stated, “As disclosed in Note 3 to these financial statements, management has recorded an account receivable of $267,028 owing from a former president (Tjelta) of the company and/or a company controlled by him.” Actually, the audit found that Tjelta had converted, for his personal use; over $400,000 during the time he was President of Marenor, of which $267,028 is outstanding.

Details of disallowed expenditures are listed within the investigators report held as evidence. Tjelta – the former president – could not/and did not pay this receivable back. In addition, Tjelta was not authorized to ‘borrow’ funds from Marenor.

As a result of the audit findings, on July 9, 1989, “Marenor Fish Ranches Inc.” issued a letter to the investors stating in part; “The Company has not been successful in its efforts to get into the business as originally intended. The original funding has been depleted and further funding not found. There are account payables that cannot be paid. Most important, the eight payments of $26,250 due to commence on June 30,1989 (Total -$210,000) to Marenor A.S., to retain the license to use the Marenor salmon farm system are in default, as legal notice has been served on the company, giving 20 days to have the default remedied, and the license is therefore about to be canceled.” Thus notifying investors the company could not pay its bills, and their investment is lost.

Rather than trying to reach a compromise with Marenor Fish Ranches Inc. principals and investors at even 10 cents on the dollar – Roy Tjelta filed for Bankruptcy protection on September 6, 1991 evidentially to avoid paying the investor back what was owed them.

Roy Tjelta past Practices – It appears Tjelta has left a trail of other victims from other investment deals gone wrong. He was sued in Bellingham, Washington on April 25, 1989 for fraud. The case was dismissed on August 1, 1997. This was detailed in a Private Investigator’s report dated June 25, 1997.

In 2012 Tjelta filed suit against Hai Yan Wang, a Chinese national, saying he was defamed by Wang in a series of emails she sent to Tjelta’s business associates, detailing his fraudulent business practices. The court eventually found for Tjelta and awarded him $20,000. The case file details numerous accusations against Tjelta for deceptive business practices and fraud which Wang could not support.

Currently Tjelta is working to raise investor money in his latest endeavor – “Empire Hydrogen Energy Systems Inc.” (http://empire-hydrogen.com/). The current management team and investors do not appear to be aware of past indiscretions.

Due diligence highly suggested prior to investing with Tjelta or his company(s).

If you have additional information please contact this forum.

{Allegations have been substantiated/evidenced and on file with an independent investigative entity}

LINKS to additional information:

https://opencorporates.com/officers?jurisdiction_code=&q=Sven+O.+Tjelta

ALL PARTIES ARE INVITED TO RESPOND & BE AFFORDED AN OPPORTUNITY TO RESOLVE DISPUTES VIA AN INDEPENDENT MEDIATION PROCESS

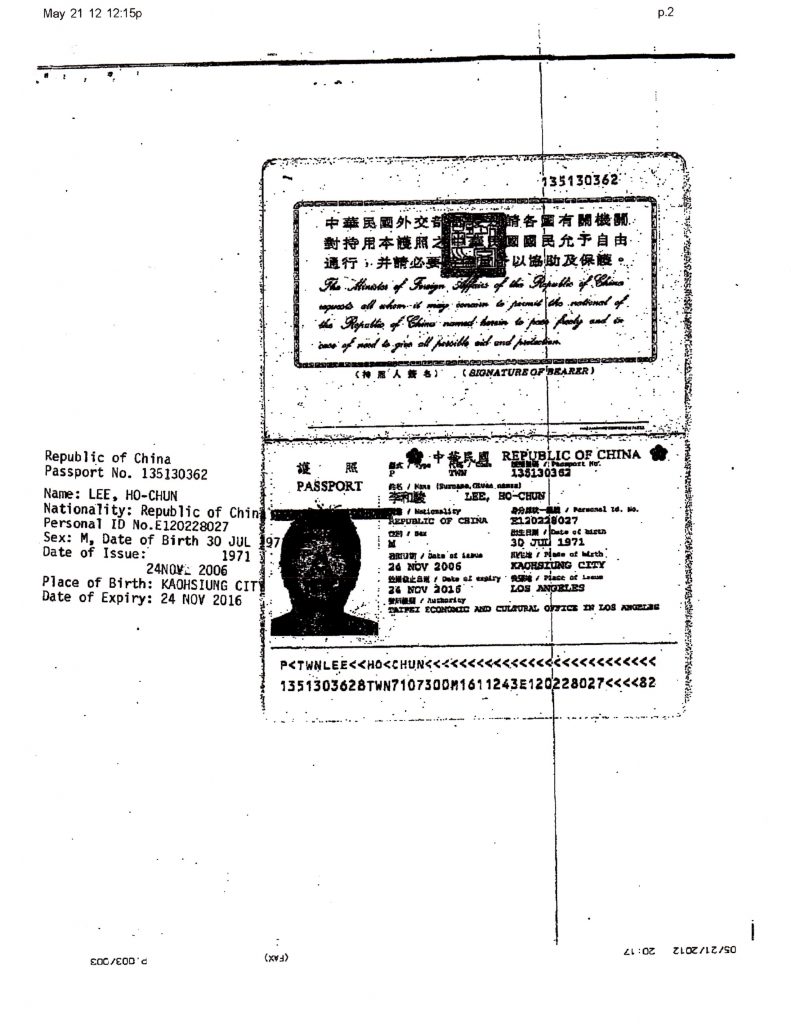

SEE PASSPORT COPY BELOW

SEE PASSPORT COPY BELOW