Raj Mahadevan, “Altos Escondidos”-Panama Fraud

BEWARE: Athisayarai Mahadevan (aka: Raj)

Altos Escondidos-Development Fraud

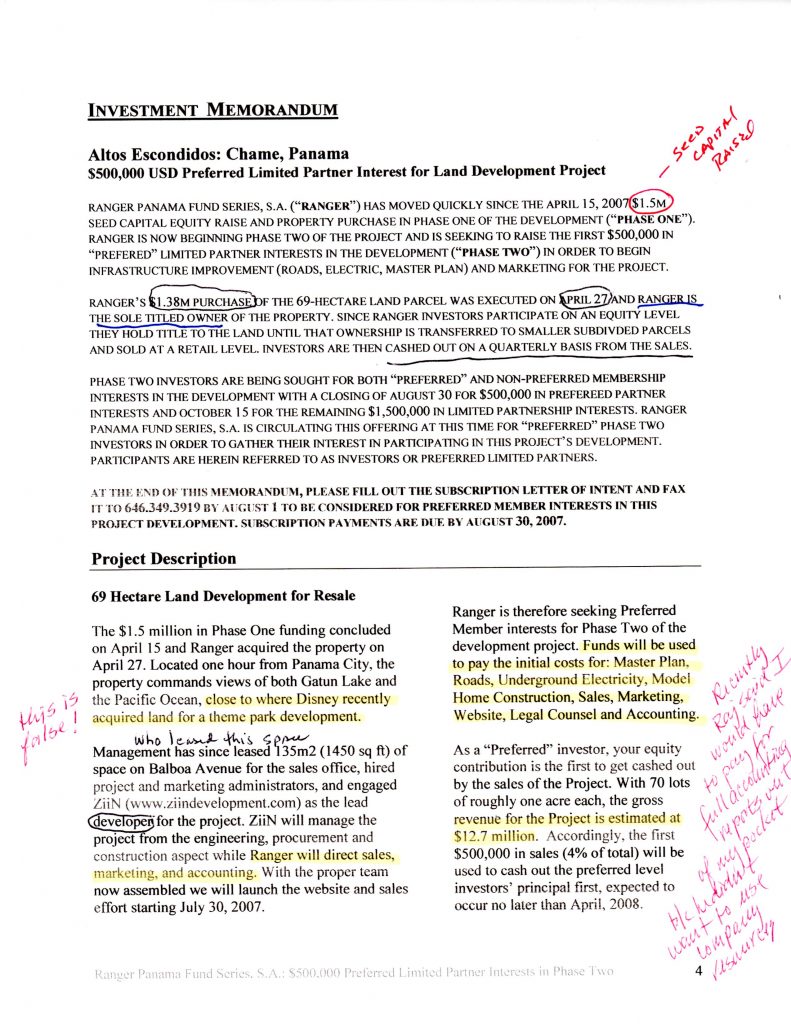

Athisayaraj Mahadevan (aka: Raj) has promoted the “Altos Escondidos” developmentin Panama since 2007. He and his original partner, Jes (Jason) Black, set up “Offering Documents” for the Ranger Panama Fund Series, S.A. The purpose/intent was to lure potential investors into an apparent ruse involving a land (Resort) development project in the inland area of the Republic of Panama which existed only through a series of misleading official papers, phony land documents with false values and repeated promises of strong returns on their investments.

The following are the facts based on victim statements and findings of a subsequent investigation:

In August of 2007, Dr. Rebecca Castaneda, a dentist in San Francisco befriended the reporting victim, a former patient. It has been alleged by one victim that Dr. Castaneda has a reputation for having used her dental practice as a front for pushing risky business or investment schemes. It is further alleged that Castaneda received referral fees for doing so.

On the surface this conduct appears to be at the least unethical conduct. Further, information has surfaced that indicates Castaneda had her own brush with the law in the past, was fined and ordered to do community service.

Castaneda misled the victim by saying she was borrowing $75,000 from her Home Equity Line to invest in Altos Escondidos. Based on the information and the materials provided and discussions with Castaneda the victim decided to invest in the Ranger Panama Fund Series, S.A – the “Altos Escondidos” Project, and wired $50,000 to Ranger Funds, LLC.

Later, when asked by the victim/patient to provide proof that she actually invested her own money in Altos, Castaneda refused to do so. Even though Castaneda is fully aware that Altos Escondidos is a scam she continues to collaborate with Raj Mahadevan to this day.

In October 2007, the victim and Castaneda met with Jes Black and Athisayaraj Mahadevan (aka: Raj), (Ranger Panama Principal Partners) in Panama City, Panama.

(“Raj” pictured below with Panama President Martinelli)

The victim understood before their trip to Panama that they would be taken by plane to the “Altos Escondidos” location for a development site visit. However, once they arrived they were told they would not be able to fly to the site location due to poor weather conditions.

After years of false promises, sketchy accounting practices, continuous misinformation the victim filed a complaint with our sister organization globaladvocates.ch in an attempt to uncover the truth. The prospectus for “Altos Escondidos” indicates that between April 15, 2007 and April 27, 2007 Ranger raised $1.5 million in seed capital to purchase the land, a “69 Hectare parcel”, for 1.38 million (US).

(“Raj” pictured at a party in Panama City)

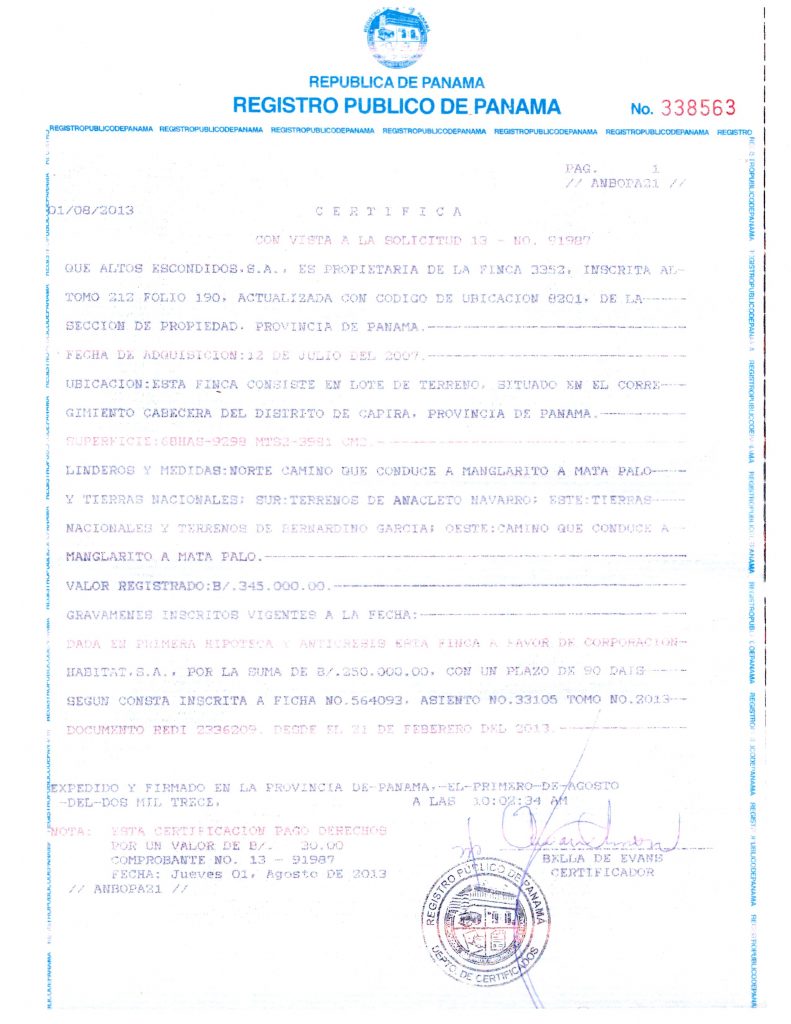

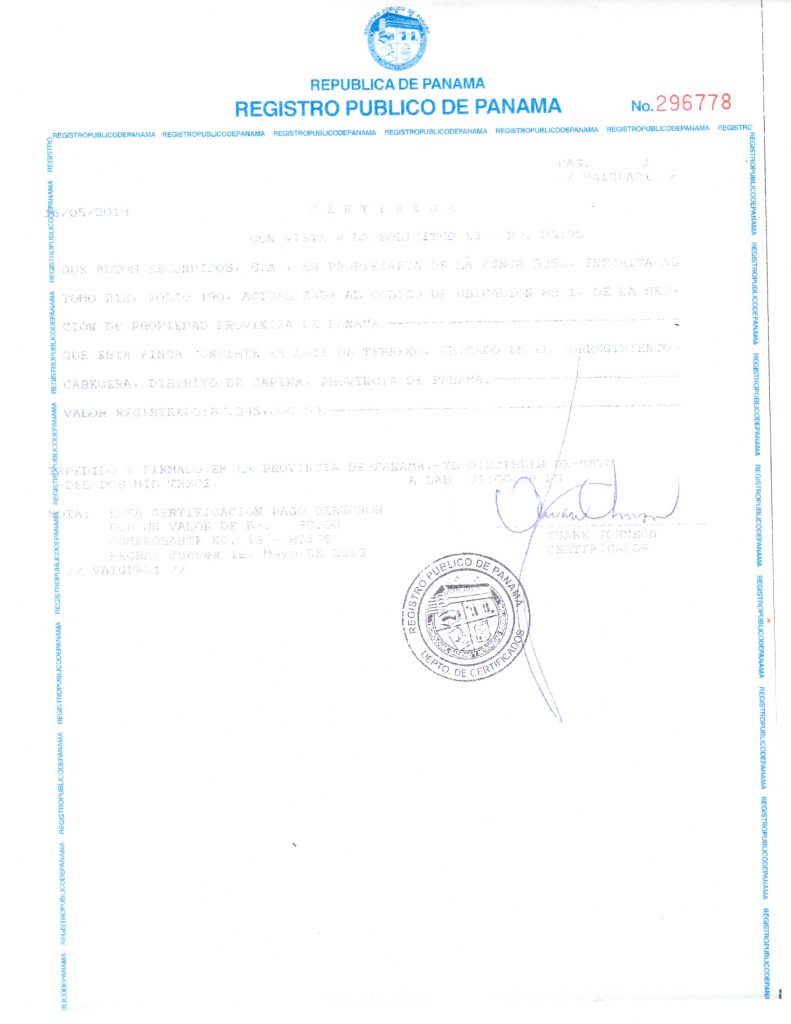

The investigation showed “Altos Escondidos” owns 69 Hectares of undeveloped land in the Capira region, northwest of Panama City. Its purchase price was $345,000 (US), not the $1.38 Million that Athisayaraj Mahadevan (aka: Raj); (pictured left at a party in Panama City) claimed he had paid for the land. It was also discovered that there is a current mortgage lien listed in government registry as of February 15, 2013 against the property for $250,000 (US) in a short-term loan. This lien continues to be listed in the public registry as an active loan. The land is registered for tax purposes (finca 3352, ubicacion 8201 is $2,000 (US), this may or may not be an attempt to defraud the government land tax authority, information regarding this is pending a review.

The investigation further revealed:  The listed office for this project is now closed at least two years, now a Gynecological medical office-for women. (See Photo Right)

The listed office for this project is now closed at least two years, now a Gynecological medical office-for women. (See Photo Right)

They victim originally visited the “Altos Escondidos” office at this same location, and received signed copies of all agreements/documents. A new address has not been provided; and the phone is disconnected.

A local contractor hired to cut roads for the project was never paid (he is owed $50,000) and he is now threatening to sue “Altos Escondidos” and Athisayaraj Mahadevan (aka: Raj); the roads were not finished.

Locals in the area have heard rumors about the project but nothing has surfaced; Phone Calls and emails to the AE office in Panama by our investigators were not returned; Annual meetings of Investors have not been held as directed by the operating agreement; Investors have been kept away from each other.

For more than six years the victim tried to get financial statements and other documents regarding the projects progress and expenditures. The victim was met with one excuse after another -why the project has been delayed and why the documents were not forth coming. The detailed case report provides documents; timelines and lists of all the promises and excuses made by Mr. Mahadevan in reference to “Altos Escondidos”. Investigators in Panama, realtors and attorneys in Panama provided vital information aiding our investigation.

When the Investigators went to the “Altos Escondidos” property; they found there was not a single presence for “Altos Escondidos”, locals spoke of project rumors but have not seen any activity or signage. Investigators did speak with a representative of Groupo Howard, identified by Mr. Mahadevan on 2-22-2011 in an email to our victim as the road builder. The representative told the investigators they contracted to cut the roads to the project but were never paid. Groupo Howard has indicated its intent to file suits against Mr. Mahadevan and “Altos Escondidos” for $50,000 – non-payment. The roads have never been completed.

(photos of Altos property taken by investigators above right show no evidence of the claimed improvements)

(Copy of Offer Memorandum, filing of lein Registration and Land Sale Registry Document #338563 & 296778 respectively from the Registro Publico De Panama are evidenced below at the bottom of this page.

Barr International http://www.barrarchitects.com/projects lists Altos Escondidos as a current project, calls to Barr regarding their progress have not been returned. [email protected] 1875 Eye Street NW, Suite 500 Washington,D.C.20006 tel:202-429-2076

BARR GROUP INTERNATIONAL LLC is a full-service Washington-based firm offering Architecture, Engineering, Interior Design, Construction Management, Development, Sustainable Design, Infrastructure, Preservation and Planning services. Established in Washington DC in 1981, the firm provides design services throughout the United States, Europe, Latin America, the Middle East and Asia.

Dr. Raj Barr Kumar; FAIA,RIBA, IIDA, USGBC is an architect, interior designer and environmentalist, and President of Barr Group international LLC and Barr-Kumar Architects Engineer PC, established in Washington, DC in 1981. Athisayaraj Mahadevan is Dr. Raj Barr’s brother.

Contact information for BARR Group International:

[email protected] 1875 Eye Street NW, Suite 500 Washington, D.C.20006 tel:202-429-2076

It is evident that Mahadevan and his brother Dr. Raj Barr Kumar are exploiting the fact that Raj Barr was a FORMER president of AIA to lend to the credibility of the Altos Escondidos fraud.

Neither US nor Panama Authorities have not been alerted at this time, allowing Mahadevan the opportunity to rectify this matter before facing regulatory or criminal sanctions.

Note: In 2007 – The National Futures Association filed a complaint against Black Flag Capital Partners LLC (NFA ID# 345533) & Jason Black (NFA IF # 344149) – Case # 07-BCC-029

Any other victims or witnesses to this fraudulent enterprise or any other perpetrated by Athisayaraj Mahadevan (aka: Raj) et, al.; are asked to contact this forum to file a complaint or offer additional testimony in the pursuit of justice.

Based on the information we have received – this project is questionable and may have been misrepresented to the public. If you have information pertaining to the projects validly and/or you are an investor still waiting for a return on your investment please contact us.

New information received indicates that “RAJ” Mahadevan may be residing in Playa del Carmen Mexico, perpetrating a similar investment scheme.

One victim contacted this forum making the following statement; “Raj Mahadevan, is a liar, cheat, con artist and cyber-bully. He scams people of their, and then when confronted attacks their character and that of the victim’s family members in an effort to intimidate them from trying to recover the funds he had stolen from them. The guy is a sick sociopath that knows no boundaries”.

A source in Playa del Carmen brought to one victims attention an article in the local paper that Raj allegedly visited “Chilly Willy’s” a local “strip club”/brothel and was pursued by police when he ran out without paying for services rendered.

Additional links to complaints against Raj Mahadevan:

ttp://www.whoscammedyou.com/current-scams/17554/sex-toy-ripoff/

http://www.whoscammedme.com/current-scams/17093/altos-escondidos-rip-off-or-dog-bite/

http://www.scambook.com/report/view/270845/Raj-Mahadevan-Complaint-270845-for-$50,000.00

Contact us at [email protected] or email us via our “contact us” page.